Effective Patent Life: Why Market Exclusivity for Drugs Is Shorter Than You Think

Dec, 15 2025

Dec, 15 2025

Most people assume that when a pharmaceutical company gets a patent on a new drug, they have 20 years to sell it without competition. That’s not true. In reality, most drugs only get 10 to 15 years of real market exclusivity - sometimes less. The rest of the patent clock ticks away while the drug is still in labs, clinical trials, and waiting for government approval. This gap between the paper patent and the actual time a company can profit is called effective patent life, and it’s the hidden reason why drug prices stay high for so long - and why generics don’t show up as fast as you’d expect.

Why the 20-Year Clock Starts Too Early

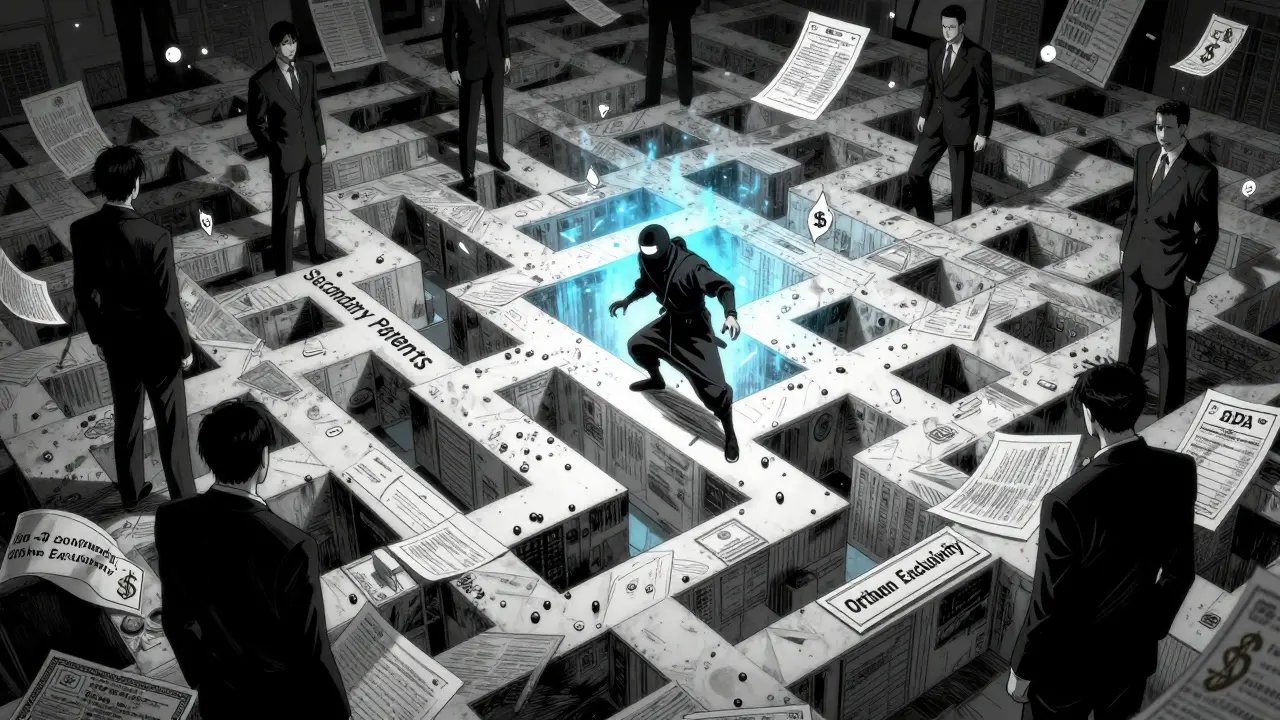

The U.S. patent system gives inventors 20 years of protection from the date they file the patent application. That sounds straightforward. But here’s the catch: most drugs are patented in the early stages of development - often before any human testing even begins. That means the 20-year countdown starts when the molecule is still just a theory in a chemist’s notebook. By the time the drug makes it to market, five to ten years have already passed. Clinical trials alone take an average of seven to eight years. Then comes the FDA review, which can add another two to three years. So by the time a patient can walk into a pharmacy and buy the drug, the patent may already be halfway gone. For many drugs, that leaves only 7 to 10 years of actual monopoly time to recoup the $2.6 billion it typically costs to bring a new medication to market.The Hatch-Waxman Act: A Compromise That’s Been Exploited

In 1984, Congress passed the Hatch-Waxman Act to fix this imbalance. The idea was simple: give drug companies extra time on their patents to make up for the years lost during regulatory review. The law allowed for a patent term extension of up to five years - but with a hard cap: no drug could have more than 14 years of market exclusivity after FDA approval. On paper, it worked. Companies got a fair shot at recovering their investment. But over time, the system got gamed. Instead of relying on just one or two core patents, companies started filing dozens of secondary patents - on minor changes like new pill coatings, different dosages, or combination formulas. These aren’t breakthroughs. They’re tweaks. But under current rules, each one can delay generic entry. A 2023 study found that blockbuster drugs often have 20 to 30 patents attached to them. These form what experts call “patent thickets” - a legal maze that makes it expensive and risky for generic makers to enter the market. Even if the original patent expires, another one might still be active. And if a generic company challenges it, the brand-name maker can trigger a 30-month legal stay, blocking approval no matter how weak the patent claim is.Regulatory Exclusivity: The Hidden Timer

Patents aren’t the only tool drug companies use to block competition. The FDA also grants separate periods of regulatory exclusivity - and these don’t even require a patent. For example:- New Chemical Entity (NCE) exclusivity: 5 years of protection for a drug with an active ingredient never seen before.

- New Clinical Investigation exclusivity: 3 years for new uses or formulations of existing drugs.

- Orphan Drug exclusivity: 7 years for drugs treating rare diseases (fewer than 200,000 patients in the U.S.).

- Pediatric exclusivity: 6 extra months added to any existing patent or exclusivity period.

How Companies Extend Exclusivity - Legally

Pharmaceutical companies don’t wait for patents to expire. They plan years ahead. Here’s how they stretch exclusivity:- Extended-release versions: Turning a pill that needs to be taken three times a day into one taken once daily. New formulation? New patent.

- Combination pills: Merging two drugs into one tablet. Even if both ingredients are off-patent, the combo can be patented.

- Prodrugs and metabolites: Slightly changing the molecule’s structure so it’s metabolized differently in the body. New patent.

- New delivery methods: Switching from oral pills to patches, injections, or inhalers. New patent.

Global Differences: It’s Not Just the U.S.

The U.S. isn’t the only country dealing with this. Canada offers a Certificate of Supplementary Protection (CSP), giving up to 24 months of extra protection after patent expiry. Japan allows up to five years of patent term extension for regulatory delays - similar to the U.S., but with different rules. The European Union has a similar system called Supplementary Protection Certificates (SPCs), which can add up to five years of exclusivity. But in countries like India and Brazil, patent laws are stricter. They don’t allow patent extensions for minor changes, and they’re more aggressive about allowing generics to enter the market. This creates a patchwork. A drug might lose exclusivity in India in year 12 but still be protected in the U.S. until year 18. That’s why generics often appear first in lower-income countries - not because they’re cheaper to make, but because the legal barriers are lower.

The Economic Impact: Billions at Stake

When a drug loses exclusivity, prices drop fast. Within the first year, generic versions can cut the price by 80 to 90%. That’s why companies spend millions on legal teams and patent filings - to delay that moment. By 2025, global sales of drugs facing patent expiration will hit $250 billion annually. For companies like Pfizer, Merck, or Roche, losing one blockbuster drug can mean billions in lost revenue. That’s why lifecycle management - the strategic extension of a drug’s market life - is now a core part of pharmaceutical business planning. It’s also why patients and insurers pay more than they should. Every extra year of exclusivity means higher prices. And every secondary patent that delays a generic adds cost to the healthcare system.What’s Being Done? And What Could Change

Critics argue the system is broken. The original intent of Hatch-Waxman was to balance innovation with access. But today, it often favors the former at the expense of the latter. There have been calls for reform:- Limiting secondary patents to only those with proven clinical benefit.

- Shortening the 30-month legal stay to 12 months.

- Requiring the FDA to publish a public timeline of when exclusivity periods end.

- Eliminating pediatric exclusivity extensions unless the study actually benefits children.

What This Means for You

If you’re a patient paying for expensive medication, understanding effective patent life helps explain why your drug costs so much - and why a cheaper version isn’t available yet. It’s not about innovation. It’s about timing. If you’re a policymaker, a healthcare provider, or even a student studying public health, this is the hidden engine behind drug pricing. The 20-year patent sounds fair. But in practice, the real clock is much shorter - and the rules have been bent to stretch it as far as possible. The next time you hear someone say, “The patent expired - why is the drug still so expensive?” - now you know the answer. It’s not about the patent. It’s about the layers of exclusivity that come after it.What is effective patent life?

Effective patent life is the actual amount of time a pharmaceutical company can sell a drug without generic competition. It’s calculated from the date the drug is approved by the FDA, not from when the patent was filed. Because drug development takes 10 to 15 years, the effective patent life is usually only 10 to 15 years - even though the patent itself lasts 20 years from filing.

Why don’t drug patents last 20 years in the market?

The 20-year patent clock starts when the patent is filed - often years before the drug is even tested in humans. Clinical trials and FDA approval take an average of 7 to 10 years. So by the time the drug hits the market, half the patent term is already gone. That leaves only 10 to 13 years of real exclusivity - and sometimes less if the patent is challenged or expires early.

What is the Hatch-Waxman Act?

The Hatch-Waxman Act of 1984 is a U.S. law designed to balance innovation and access. It allows brand-name drugmakers to extend their patents by up to five years to make up for time lost during FDA review. But it also created a faster path for generic drugs to enter the market. The law limits total market exclusivity to 14 years after FDA approval - but companies now use secondary patents and exclusivities to bypass that cap.

Can a drug have exclusivity without a patent?

Yes. The FDA grants regulatory exclusivity separately from patents. For example, a new chemical entity gets 5 years of exclusivity even if no patent exists. Orphan drugs get 7 years. These protections block generics regardless of patent status - and they can stack on top of patents, creating longer delays.

Why do some drugs have so many patents?

Companies file dozens of secondary patents on minor changes - like new formulations, delivery methods, or combinations with other drugs. These aren’t always better for patients, but they legally block generics. High-revenue drugs often have 20 to 30 patents. This strategy, called “evergreening,” creates legal barriers that delay competition and keep prices high.

How do generics finally get approved?

Generic companies file an Abbreviated New Drug Application (ANDA) with the FDA after all patents and exclusivities expire. But if a brand-name company sues them for patent infringement, the FDA can delay approval for up to 30 months - even if the patent is weak. Only after the court rules in favor of the generic, or the stay expires, can the drug be approved.

Does every country handle patent life the same way?

No. The U.S. allows up to five years of patent extension and multiple types of exclusivity. Canada and the EU offer similar extensions. But countries like India and Brazil have stricter rules - they don’t allow patents on minor changes and approve generics faster. That’s why generics often appear first in lower-income countries.

What happens to drug prices after exclusivity ends?

Prices typically drop by 80% to 90% within the first year after generic entry. Multiple generic manufacturers enter the market, driving competition. For example, a drug costing $10,000 a year might fall to under $1,000. This is why pharmaceutical companies fight so hard to extend exclusivity - losing it means massive revenue loss.

Is there a way to shorten the time before generics arrive?

Yes - through policy changes. Limiting secondary patents to those with real clinical benefits, shortening the 30-month legal stay, and requiring transparency in patent filings could help. Some states are already allowing drug importation from countries with faster generic access. Federal reform is slow, but pressure is growing as drug costs continue to rise.

How does this affect patients and insurers?

Patients pay more for longer because generics are delayed. Insurers and government programs like Medicare spend billions more each year because of extended exclusivity. Every extra year of monopoly means higher premiums, higher out-of-pocket costs, and less access to affordable medication. The system was meant to reward innovation - but now it often rewards legal strategy instead.

Lisa Davies

December 15, 2025 AT 04:36This is such an eye-opener. I had no idea patents started ticking the moment a drug was just a theory in a lab. It’s not about innovation-it’s about legal chess. And patients are the ones paying the price.

Every time I see a $12,000 prescription, I now know: it’s not the science that’s expensive-it’s the delay tactics.

RONALD Randolph

December 16, 2025 AT 16:45Let’s be clear: this isn’t ‘innovation’-it’s corporate fraud. Patent thickets? Regulatory gaming? These aren’t loopholes-they’re exploits. And the FDA? They’re complicit. The U.S. is being robbed-by design-and it’s disgusting. We need criminal charges, not ‘reforms.’

Michelle M

December 16, 2025 AT 18:58It’s funny how we celebrate innovation in tech but punish it in medicine. A phone gets updated every year-no one bats an eye. But if a drug gets a new coating, suddenly it’s a ‘breakthrough’? The system rewards manipulation over meaning.

Maybe we need to measure value by lives improved-not patents filed.

Nupur Vimal

December 17, 2025 AT 23:09Benjamin Glover

December 18, 2025 AT 05:11Typical American entitlement. Other nations manage without these convoluted extensions. The U.S. system is a circus. It’s not broken-it was designed this way. For profit. Not patients.

Christina Bischof

December 18, 2025 AT 09:39I just read this after my mom’s insulin bill came in. $500 a month. And she’s been on it for 15 years.

It’s not that the science is hard-it’s that the system is rigged. I’m tired of being told to ‘be grateful’ for medicine that’s priced like a luxury car.

Raj Kumar

December 18, 2025 AT 16:41Jake Sinatra

December 19, 2025 AT 03:10The Hatch-Waxman Act was intended as a compromise, not a loophole factory. The original intent-balancing innovation and access-is being subverted by legal teams with billion-dollar budgets. We need a return to the spirit of the law, not its exploitation.

Regulatory exclusivity should not be a tool for indefinite monopolies. Clinical benefit, not cosmetic changes, must be the threshold for extension.

Mike Nordby

December 19, 2025 AT 09:34It’s worth noting that the 20-year patent clock predates modern drug development timelines. The system was designed for mechanical inventions, not biologics requiring a decade of trials.

Perhaps the solution isn’t to punish pharma-but to reform the patent framework to reflect reality. Start the clock at FDA approval, not chemical synthesis. That alone would restore balance.

John Samuel

December 19, 2025 AT 13:47The pharmaceutical industry doesn’t just sell drugs-they sell time. And they’ve turned time into a commodity, packaged in patent filings, regulatory filings, and legal stays. What we’re witnessing isn’t capitalism-it’s rent-seeking on a planetary scale.

Every secondary patent is a toll booth on the highway to health. And the toll collector? A shareholder meeting in New Jersey.

Cassie Henriques

December 20, 2025 AT 12:41Let’s not forget pediatric exclusivity-6 extra months just for doing trials in kids? Sounds noble, but 80% of those studies are just rehashes of adult data. It’s regulatory theater. And the cost? Billions in overpayment.

Real pediatric innovation? Rare. Legal maneuvering? Abundant. The FDA needs to audit these extensions like a tax return-not rubber-stamp them.